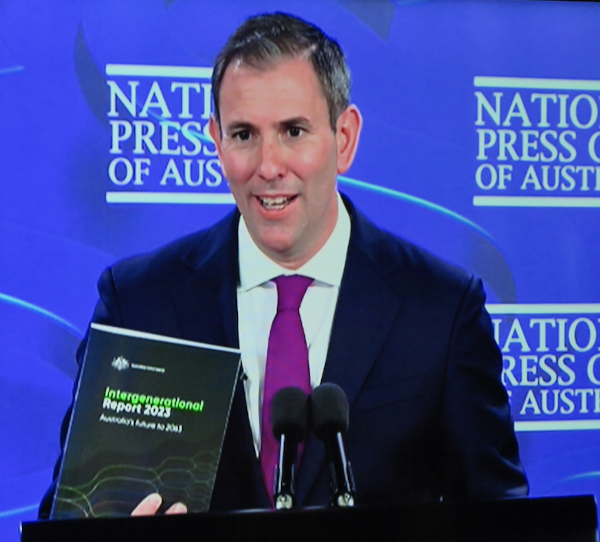

It seems safe to predict that by the end of the forty year time-frame encompassed by the 2023 Intergenerational Report, the sixth produced by Treasury, many readers will have shuffled off this mortal coil, or be well and truly retired. Even the Treasurer himself, as fit as the jogging keeps him, will have hung up the calculator.

But that leaves the rest of the Australian population, predicted to reach 40.5 million, much more than today, living in an economy that could have grown by an average of 2.2 per cent per year in real terms (although less than the 3.1 per cent growth over the past 40 years), and with real incomes around 50 per cent higher.

If that sounds like a lotus land, think again, because Australian Government payments for health care, aged care and the NDIS are projected to increase as a share of GDP from 6.2 per cent in 2022–23 to 10.7 per cent in 2062–63. One of the main reasons is something we can do little about – the ageing process.

Today’s life expectancies at birth are 81.3 years for men and 85.2 years for women. By 2062–63 these are expected to be 87.0 years for men and 89.5 years for women.

As the “IGR” - Treasurer Chalmers’ abbreviation - notes, ‘Over the next 40 years as the population ages more people will fall into the older age groups that are the most frequent users of the public health system.’

At present, it tells us, people aged 65 or older currently account for around 40 per cent of health spending, despite being only 16 per cent of the population. In forty years, the number of people aged 65 and over will more than double and the number aged 85 and over will more than triple.

The costs will be astronomical. Real total health spending on those aged over 65 years is expected to increase around six-fold, with that on those over 85 years to increase around nine-fold.

Then there’s the expanded level of aged care spending, the key driver being the number of people aged over 80. This cohort is expected to triple over the timeframe, to more than 3.5 million people by 2062–63.

With understatement, the IGR says, ‘This will exert considerable pressure on aged care spending.’

Surprisingly, Australia’s population is expected to remain younger than most advanced economies whose revenue raising approaches, notably income tax and more notably in the Nordic countries, might become a model for Australia to follow. At present, the major parties have no wish to discuss tax hikes, and the IGR only hints this could be necessary because of lower birth rates and less paid workers in the economy.

‘Changes to the structure of the economy over coming decades could also see other shifts in the composition of the tax base,’ it says.

‘Governments will need to make choices about how they respond to these shifts in the economy and tax bases while maintaining sustainable public finances and funding essential services.’

Leaving aside the likely ballooning cost of nuclear power submarines, which don’t get a specific mention in the report, the five main spending pressures are in health, aged care, the National Disability Insurance Scheme, defence, and debt interest payments. These are projected to rise from around one-third to around one-half of all government spending.

In report-speak, Australians are living longer in full health, with more time using government-funded services.

‘Demand for access to the highest standards of care and rapid technological innovation will also place pressure on the Government to increase expenditure,’ it suggests.

‘Increased longevity, alongside low fertility rates, means the population will continue to age over the next 40 years. Population ageing will be an ongoing economic and fiscal challenge.’

The five major forces that will shape the Australian economy over the coming decade are:

- population ageing

- technological and digital transformation

- climate change and the net zero green house gas emissions

- rising demand for care and support services

- geopolitical risk and fragmentation.

Another key yardstick is the ‘old-age dependency ratio’, which measures the number of people aged 65 and over for every 100 people of traditional working age (15 to 64 years). This is projected to continue to rise, increasing from 26.6 per cent to 38.2 per cent, reflecting the size of the population aged 65 and over growing faster than the working age population. The old-age dependency ratio for First Nations people is, sadly, much lower, standing at 8.8 in 2021.

‘Considering escalating health pressures, it will be important to ensure that the health system provides value for money,’ the IGR, i.e. the Government, says.

‘This requires a health system that innovates and prioritises funding a patient-centred and sustainable Australian healthcare system that delivers the best outcomes for communities. This will require funding arrangements that continue to effectively invest in preventive health and evidence-based health care spending.

‘The Strengthening Medicare Taskforce Report released by the Government on 3 February 2023 sets out a recommended pathway for significant reforms to strengthen Medicare and to rebuild primary care. In response to the report, the Government invested $5.7 billion in the 2023–24 Budget to support better access and more affordable care for patients.’

Reports seem to be coming thick and fast, with another recent one, Measuring What Matters (covered in a separate article in this issue) being references in the IGR and in the Treasurer’s Press Club speech. One we’re clear on what we know and what we think might happen, hopefully there will be action on what must be done to achieve a healthier, happier and more equitable nation.