The Superbowl is the final of the American National Football League and a major event in the calendar for many Americans. There are about 12 minutes of live action in the three hours it takes to play and much of the intervening time is spent on advertisements.

These ads tap into the zeitgeist of American life and are a bellwether for future fashions. For many the Superbowl is a must watch event. Must watch for the ads, that is, not the game.

At this year’s Superbowl there were four advertisements for crypto currencies. At $13 million for sixty seconds they don’t come cheap but the wild ride of crypto speculation has fueled fortunes for some early adopters and there is a large market of new entrants. Thousands of companies are competing for this attention in America, Australia and around the world. You don’t want to miss out. Don’t be like Larry.

Larry David Crypto Commercial. FTX Super Bowl Commercial 2022

The internet has revolutionised many aspects of modern life. The way we work, get paid and pay our own bills have all changed radically in the last 30 years. Fewer and fewer people use cash for everyday transactions. As entrepreneur Elon Musk has noted, the world of money and finance is now simply the movement of bits between interconnected databases.

The downside of this is that all transactions are run through intermediaries who charge a fee for the service. This can vary from two to three percent for standard transactions and up to 10% or more for those repatriating small sums to family member’s overseas accounts.

Another disadvantage of relying on the financial system is that access can be denied. You can even have your assets seized by the government. This may occur if you are deemed a bad person (freedom fighter / terrorist) or from the far left or right. Cryptocurrencies are popular in countries that do not have strong legal systems.

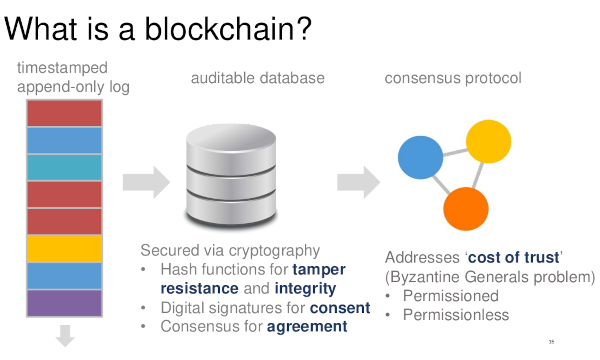

For many years mathematicians and cryptographers around the world have tried to find a way to conduct secure transactions between two parties that relied neither on a trusted intermediary nor on the honesty of the other party.

They had to solve “the double spend” problem of using a crypto coin twice. This is essentially equivalent to making your own counterfeit coin and spending both it and the original. The solution came in 2008 when Satoshi Nakamoto created bitcoin.

Bitcoin relies on only a few mathematical concepts. Cryptographers mulled over the proposal for a few years before finally accepting it as a workable system for digital money. Perhaps some of the slowness in uptake was due to the fact that Nakamoto was a pseudonym and the inventor's true identity was not known and his, or her, identity remains a mystery to this day. .

Blockchain 101 - A Visual Demo

In 2011 the first real world transaction using bitcoin occurred when Laszlo Hanyecz famously bought two pizzas for 10,000 bitcoin. The currency has appreciated since then and in today’s dollars this would appear to be poor value for money. (1BTC = $A54,146.12 at the time of writing).

Bitcoin succeeded because it was the first successful solution to the double spend problem where there is no trusted party. Nakamoto achieved this by making it too expensive for bad actors to subvert agreement on the next valid block in the chain. A 51% consensus is enough to validate that block and make the transaction records it contains, and its predecessors, immutable. The past cannot be rewritten.

The cost of continuing the chain is determined by finding, through a process referred to as mining, a valid hash of the transactions contained in the block. This cost has gone up over time and is measured in processing power and more particularly the cost of electricity to power the thousands of computers that make up these mining farms. The cost to power the bitcoin system varies but is now greater than that of many smaller countries.

Environmentalists and others have questioned these costs and alternatives have been devised.

Instead of letting anyone find the next block in the chain by using vast amounts of electricity it would be simpler and cheaper to only allow a small group of trusted entities to determine the next block. In the jargon of cryptocurrencies you would have a permissioned not permissionless system. Blocks are added by trusted entities with a “proof of stake” in the system, not by anonymous miners around the world using a “proof of work” (by burning through a lot of electricity).

While permissioned blockchains are faster and less energy intensive they lose the pseudonymity that permissionless blockchains provide. You are back to relying on other parties who will charge a fee, albeit smaller, than the banking system’s.

Blockchains are an example of distributed ledger technology (DLT) and have important uses outside of finance where the maintenance of the historical record is paramount. They can be used in property settlements and supply chains where documentation of the passing of ownership from one entity to the next is the critical component.

The distributed ledger becomes the canonical record, the final unalterable source of truth. Since it is replicated on multiple nodes (computers) around the world it greatly reduces the difficulty and cost of verifying transactions. Hundreds of these use cases have been proposed.

There are some projects that are delving into the use of these DLTs in medicine. While some scenarios, like the production and distribution of medications, are clear the benefits in others remain to be established. (The use of blockchain and DLTs in medicine will be the subject of an article in a future edition.)

Bitcoin as an open source program has been the basis for literally thousands of similar projects. These efforts are launched through a process called an initial coin offering (ICO). ICOs reached their peak in 2017 when the promoters made millions of dollars but many were scams and investors lost all their money. Over 95% of new coins failed.

Perhaps the advice “Don’t be like Larry” is wrong. Larry made his money in an entirely different enterprise and has cashed in by pretending to be “the greater fool”.

Note: The author was the owner of 0.98 of a bitcoin in 2014 before it was lost in the Mt Gox scam of that year.